Introduction

Dear Fellow Investor/Trader,

Let me tell you a bit about myself:

I’m a big-picture-guy who likes to ponder over the big questions in life. At the same time, I like to tinker with things and figure out how they work – the bigger the thing, the stronger the attraction. Tinkering means that I often have to zoom into the minute details of how specific aspects of the thing function – and that often takes me down deep, narrow rabbit-holes. I suffer from claustrophobia, so the moment I’ve learned what I need to, I hurry back out of the hole and climb back onto my mountain from where I can see the big picture. This is a handicap, as it means that I struggle to specialize in any particular narrow field. The moment I think I have it figured out, I lose interest and start looking for something more challenging.

This led me to markets – the ultimate challenge that can never be figured out because the puzzle keeps changing – so I guess now I’m stuck, forever… It sounds worse than it really is – I like being stuck here…

The first big thing I wanted to figure out was in my teenage years. It was in the late 80’s, early 90’s. I was an avid computer gamer and wanted to program my own adventure game. But in those days, there were no game engines, so I set out to learn coding and to build my own engine. I got as far as the graphics generator and built the opening scene of the game – only to realize the immensity of the project. I reached a juncture where I had figured out how to build the game, yet I recognized a lack of commitment and dedication to see it through to completion. Consequently, after about 2 years of coding, I decided to quit.

My next big challenge came after my studies and a gap-year of working in the UK. I decided that I wanted to figure out how to build a business and then sell it. To make a very long story short, this 5-year project turned into a 17-year one because this thing, I couldn’t drop as easily as a computer game.

Firstly, it was very stimulating because, in building and running a business, you never run out of challenges. In fact, entrepreneurship is synonymous with problem-solving. Secondly, my entire net worth was locked up in this business, and I simply had to see it through. After a baptism of fire, two recessions, and a few near bankruptcies, I finally made a success of the business and sold it 17 years later.

This brings us to my current big challenge – the most stimulating and enjoyable one thus far – “Solving the market” – or at least, that is what I set out to do, but soon discovered that a puzzle that keeps changing can never be solved. The only thing that can be solved here is “how to make some money in the market”. This is the first thing one needs to learn in this game: you don’t have to make predictions or be “right” in order to make money investing and trading. You only need a process that allows you, over time, to make more money than what you lose. You can even lose more often than you win, as long as the size of your winners makes up more than enough for those many small losses. The formula is very simple:

P&L = number of winners x average size of winners – number of losers x average size of losers.

All you need to do is to ensure that the result is positive. Simple? Well, it sounds simple, but doing this successfully over time is not – especially if you (like me) are not very good at executing mindless repetitive tasks day in and day out. Yes, this is why most investors/traders fail – not because they’re not smart enough, but because they don’t want to work hard enough. It is that simple!

So, I’m not saying that I don’t want to work hard, in fact, I can work very hard, but not if I’m not enjoying the work. Executing a set of trading rules or digging through company results day in and day out is not my idea of fun. But if it is, you can be very successful.

I agree with Jack Schwager that the most important thing about investing and trading is to find a methodology that suits your personality and style. (Paraphrasing).

I set out to learn everything possible about various strategies, to test them, and then to develop my own approach by blending the parts that resonated with me. The hardest part, in my view, is to clearly define your methodology and then build a rigorous process around it, and to follow it diligently. The kind of diligence I’m talking about here isn’t the same as the tedious execution tasks I mentioned earlier. It doesn’t have to be mind-numbing; after all, you’re crafting it to be something you enjoy. Sure, there will always be elements you’re not as keen on, which you might automate or outsource as you scale your investment. The point is that developing an investment approach is an open-ended evolutionary endeavor. Designing this process to fit your personal preferences and style is key to succeed in growing your wealth.

This website serves as a conduit for sharing the insights and lessons from my own journey in shaping my investment methodologies. It is an invitation to engage, learn from my experiences, and navigate around the pitfalls I’ve encountered. Equally, I look forward to the valuable perspectives you might share with me.

Portfolios

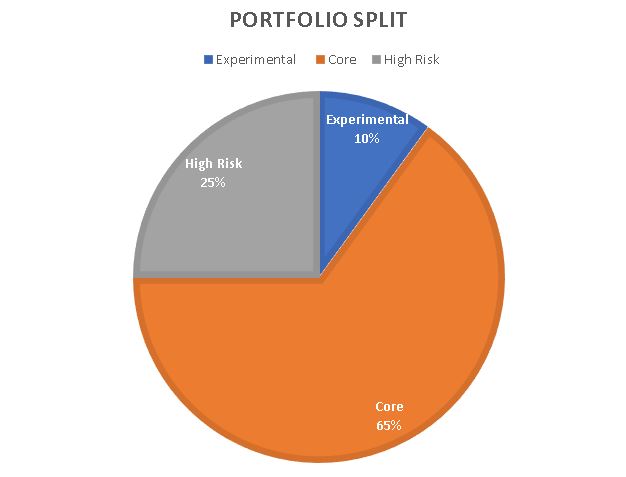

My liquid net worth (This excludes property and illiquid venture capital investments) is divided into three broad buckets:

1. Core Portfolio

The core portfolio contains the bulk of my liquid net worth and the purpose of this portfolio is to protect capital while compounding at an above inflation rate over the long term. I am a risk-averse investor and therefore I am targeting a low volatility profile with this bucket of my assets.

For purposes of this web site, I will only share information about my Core Portfolio. For more details about this portfolio, click the link below.

2. High risk Portfolio

This is a smaller portfolio than the core one, and the purpose is to take higher risk with the aim to compound capital at double digit annual returns. This portfolio will typically contain medium term thematic macro bets, nacent asset class allocations, special opportunity equity positions and tested algorithmic trading strategies.

3. Experimental Portfolio

This is a small portion of my total liquid assets and the purpose of this portfolio is mainly to experiment and learn. The returns of this portfolio is very volatile and very lumpy. The main aim is not even to have positive returns in this portfolio (but it would be nice). The main aim here is to learn and develop strategies.

Successful experiments will end up with an allocation in the high risk portfolio and from there it could migrate into the core portfolio, but the core does not only draw from the high risk portfolio.

I share ideas about my high risk and experimental portfolios on my Twiiter/X account. Follow along by clicking the link below:

Methodology & Process

The parts of investing and trading that appeal to me and align with my skills and interests involve understanding the economy, industries, companies, the financial system’s construction and operation, the influence of investor psychology on the economy and markets, and how various trading and investing strategies capitalize on different market regimes. These are all big-picture concepts, and I have less interest in detailed company financials, deciding on position entries and exits, and the daily execution of specific strategies. Consequently, I aim to outsource or automate as many of these tasks as possible. While these functions are mission-critical and should not be neglected or abdicated, they can be delegated or partially automated. This frees up my time to focus on the big picture, where my skills lie and what I find enjoyable

Hence, my primary role in this methodology involves comprehending the environment, generating new ideas and strategies, testing them, identifying managers or algorithms for execution, allocating capital, and then monitoring performance for necessary adjustments.

My core portfolio investment process in broad strokes:

- Identifying the current market regime and anticipating the timing and nature of the next one.

- Selecting the most suitable investment and trading strategies for the current and upcoming environments.

- Exploring and assessing various implementation methods for the chosen strategies.

- Constructing the portfolio, allocating capital to strategies, and managing risk.

- Reviewing performance and making adjustments and enhancements to the process.